Product and Insight

Summary

- Group risk insurance offers employers a way to show that they really care about their employees. But what is the insurance promise and how is it delivered?

Employers are increasingly recognising the importance of looking after their employees’ health and wellbeing. Research by Aon found that 95% of companies believe employers have a responsibility for the health and wellbeing of their employees.

This is great news for employees, but it makes good business sense too. Healthy employees tend to be more productive and take fewer days sickness absence.

Additionally, by offering health and wellbeing support, it shows the employer cares. This is appreciated by employees, helping to drive up engagement, reduce staff turnover and attract talent.

Setting out the promise

Employers include the key benefits in the employment contract to show their commitment to employees. This is a legal document, setting out the formal rules governing the provision of benefits in the event of the employee’s death or if they are unable to work long-term due to illness or injury.

Once the promise is made, the employer needs to decide whether they are prepared to self-insure and take the risk themselves or arrange insurance to take care of some, or all, of this financial commitment.

Benefits of group insurance

Arranging insurance to cover these promises enables an employer to transfer the risk to the insurer, in exchange for a monthly premium. Although the probability of someone dying while of working age is relatively low, if it does happen, it can be a significant financial shock for an employer without insurance.

For example, Company X gives its employees four times salary if they die. An employee is diagnosed with cancer and dies six months later. As they were on a salary of £100,000, Company X would pay the bereaved family £400,000.

Having to suddenly find this money might not be an issue for a large multinational company, but it could prove challenging for a small company or one without access to cash.

Insuring the promise through a group insurance policy removes this financial risk. Instead, in exchange for a regular premium, the employer has the reassurance that, if the worst does happen, they can keep their promise to their employees.

More than money

Insurance propositions also go far beyond the financial commitment. Modern group risk policies include a range of health and wellbeing services that can help employees and employers, whether or not there’s a claim.

These services can include health information and advice, employee assistance programmes with access to counselling, health risk assessments, and wellbeing apps.

Support is also available in the event of a claim. Families can benefit from bereavement and probate support through a group life policy, while the early intervention and rehabilitation services available through group income protection can help an employee get back to health and work quickly.

These services are valued by employees. As well as supporting them and their families through tough times, they can help them adopt healthier habits.

Employers can also use them to support – or replace – an existing health and wellbeing strategy. Or as the first parts of a completely new strategy.

Employer-paid or employee choice

Although it’s common for an employer to take out group risk insurance to cover any promises made in the contract of employment, they could also offer it on a flexible or voluntary basis.

Both flexible and voluntary benefits give the employee more choice over the cover they have, which can work well alongside today’s diverse workforce.

Flexible benefits

Under a flexible benefits scheme, the employer provides a core level of benefits, and the employee then chooses what they want.

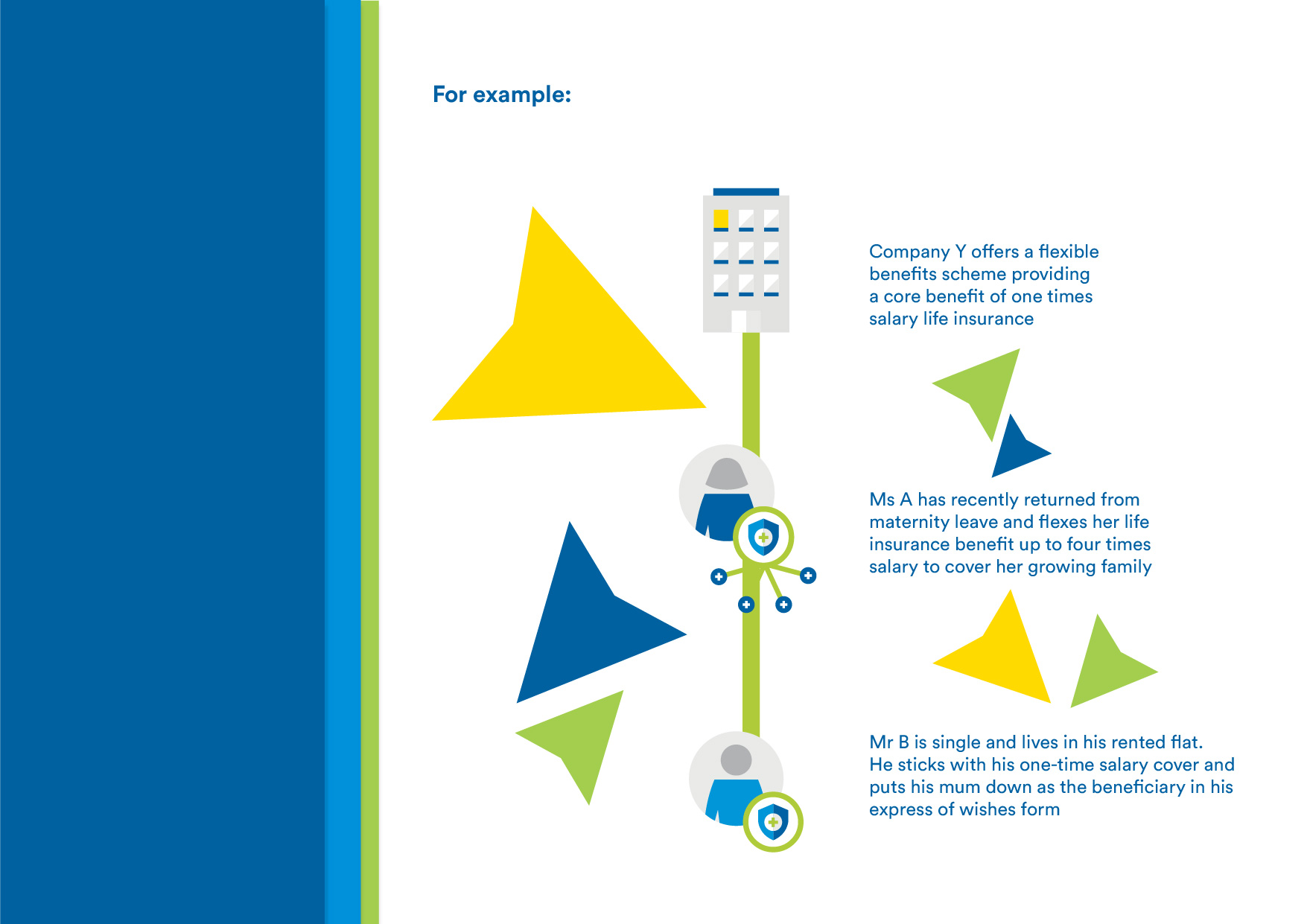

As an example, Company Y offers a flexible benefits scheme providing a core benefit of one times salary life insurance.

Ms A has recently returned from maternity leave and flexes her life insurance benefit up to four times salary to cover her growing family.

Mr B is single and lives in a rented flat. He sticks with his one times salary cover and puts his mum down as the beneficiary in his expression of wishes form.

Voluntary benefits

Group risk benefits could also be provided on a voluntary basis. With this, the employer provides employees with access to a range of benefits that they can buy themselves.

This is less generous than offering company-paid benefits but there are still advantages for employees. Cover is easier to take out than if they had to arrange it themselves and is usually better value too. Also, because it’s endorsed by the employer, it gives employees more confidence to take out cover.