Technical

A free cover limit is the maximum amount of insured benefit that all scheme members can have before they need to be medically underwritten.

Also known as the automatic acceptance limit, the free cover limit allows a group risk insurer to strike a balance between the cost of medically underwriting a scheme and the risk of a claim.

This helps to streamline the application process. On many schemes, most employees’ life cover will fall under the free cover limit so they can be covered quickly and efficiently.

Here’s an example of how a free cover limit works:

A group life scheme for a company with 25 employees has a free cover limit of £500,000. This means that only those members who have more than £500,000 of group life cover need to provide information about their medical history.

The company is offering staff life cover of four times salary. Twenty-three members of staff earn less than £100,000 a year so their group life benefits fall within the free cover limit.

The remaining two – the finance director and the marketing director – earn £250,000 and £200,000 respectively. At four times their salaries – £1,000,000 and £800,000 – their benefit is above the free cover limit and they need to provide details of their health to the insurer.

Where the insurer requires a member to provide medical history, it uses this information to assess whether it’s comfortable offering standard terms or if it needs to load the premium or add an exclusion to reflect the higher risk.

Even where the result of the medical underwriting means the insurer is unable to offer cover in excess of the free cover limit, the member will still be covered up to the free cover limit, providing they join the scheme at their first opportunity.

Size matters

Free cover limits vary from scheme to scheme, with the size of the scheme a key determinant of the level that’s available.

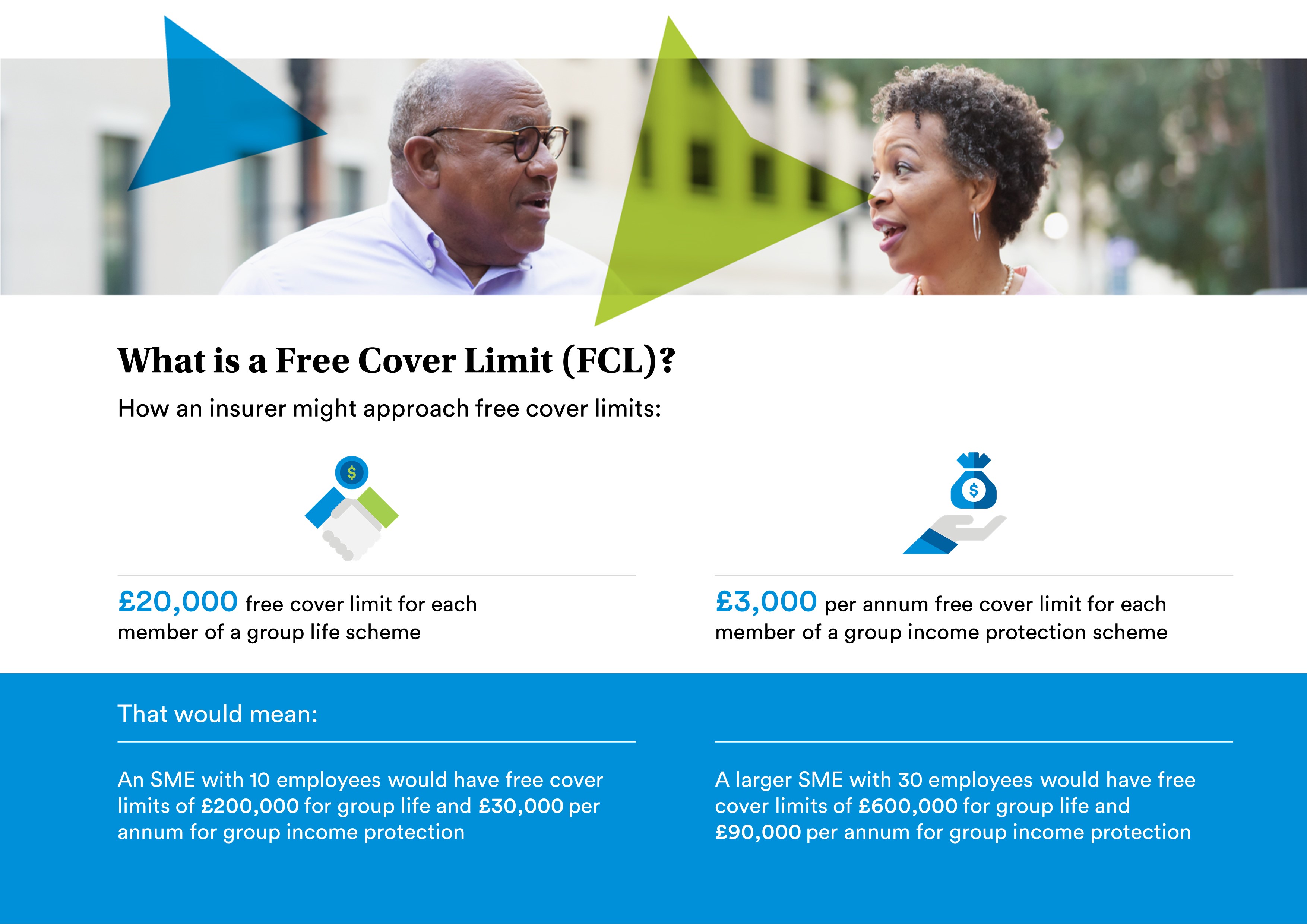

As an example, an insurer might use the following criteria to determine the free cover limit for a small-to-medium-sized employer (SME):

- £20,000 free cover limit for each member of a group life scheme.

- £3,000 per annum free cover limit for each member of a group income protection scheme.

An SME with 10 employees would have free cover limits of £200,000 for group life and £30,000 per annum for group income protection.

A larger SME with 30 employees would have free cover limits of £600,000 for group life and £90,000 per annum for group income protection.

Room for negotiation?

There is some room for negotiation around free cover limits.

An adviser may have access to enhanced free cover limits due to their experience and relationship with an insurer. It’s also possible to request higher free cover limits and the underwriters will assess whether this is appropriate on a case-by-case basis.