Technical

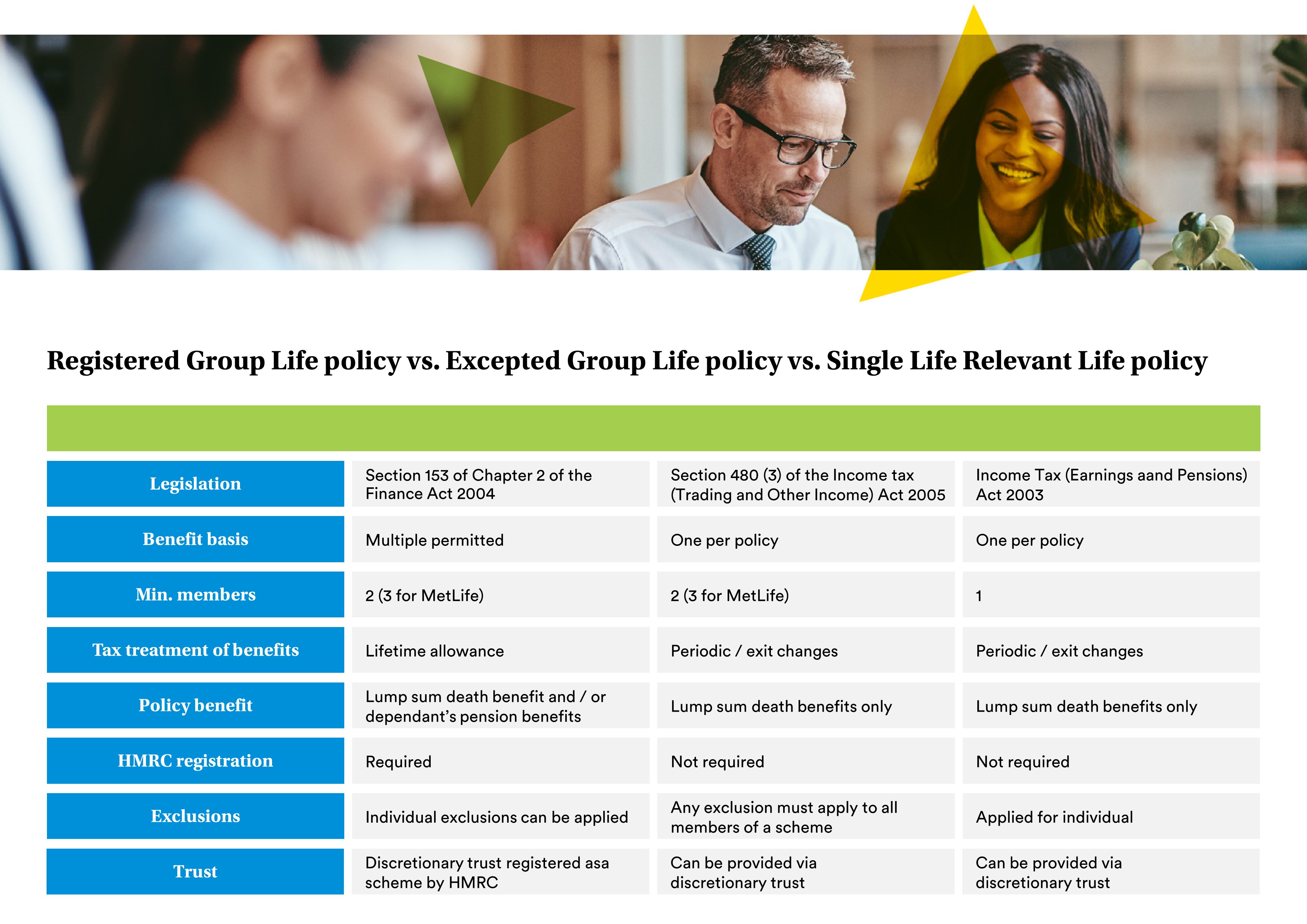

When it comes to setting up a Group Life arrangement, there are a few different options available. Employee circumstances will determine which is – or are – the most appropriate.

Registered Group Life Policy

A Registered Group Life Policy (RGLP) is the most common form of cover. In 2021, 8.31 million people were covered by this type of policy according to Swiss Re’s Group Watch 2022.

RGLPs insure a registered pension scheme, which is a discretionary trust registered with HMRC for certain tax reliefs. This brings some advantages. Employees can have different levels of cover and benefits can be structured to pay a lump sum and/or a dependant’s pension. Exclusions can also be applied on an individual basis Benefits do not form part of the member’s estate so there’s no inheritance tax.

They are subject to pension scheme rules so any death benefit that is paid counts towards the member’s lifetime allowance (£1,073,100 for the tax year 2022 / 2023). Benefit paid in excess of the member’s lifetime allowance is subject to a tax charge of up to 55%. Additionally, employees with large pension pots who applied for lifetime allowance protection risk losing this protection if they join a registered pension scheme.

Excepted Group Life Policy

An Excepted Group Life Policy (EGLP) isn’t subject to the pension scheme tax rules so can provide a solution for those employees affected by the lifetime allowance. As a result, they have grown in popularity over the last decade, with more than 2m members in EGLPs according to Swiss Re’s Group Watch 2022.

Although they’re not subject to pension tax rules, excepted group life arrangements are subject to discretionary trust tax legislation. This means they have more complex inheritance tax rules, with entry, periodic and exit charges potentially applying.

While they might be a great way to provide life insurance benefits to employees affected by the lifetime allowance, EGLPs don’t have the same flexibility as RGLPs. All members must have the same benefit basis, including the same termination age, salary definition and so on. An EGLP can only provide lump sum death benefits too.

Employers often set EGLPs up specially for employees who can’t join the registered pension scheme and they must have at least two members (subject to an insurer’s own minimum requirements).

Single Life Relevant Life Policy

A Single Life Relevant Life Policy (SLRLP) is another option. These are similar to an EGLP but, as the name suggests, are only set up for one member.

Benefits are not subject to the lifetime allowance, but, as they’re subject to discretionary trust tax legislation, there are potential entry, periodic and exit charges to consider.

Selecting the right type of arrangement requires careful consideration of the tax implications for members. Helping clients to get the right tax and legal advice will ensure that they and their employees have the arrangement that suits their circumstances.