How an employee benefit quote works

Let’s explore the information required to build and accurate quote for Group Life and Group Income Protection cover.

How an employee benefit quote works

Let’s explore the information required to build and accurate quote for Group Life and Group Income Protection cover.

Understanding the nature of a business, its employees and the type of cover required is key to accurately underwriting and pricing the risk. To gain this understanding, group risk insurers will request a variety of information during the quotation process.

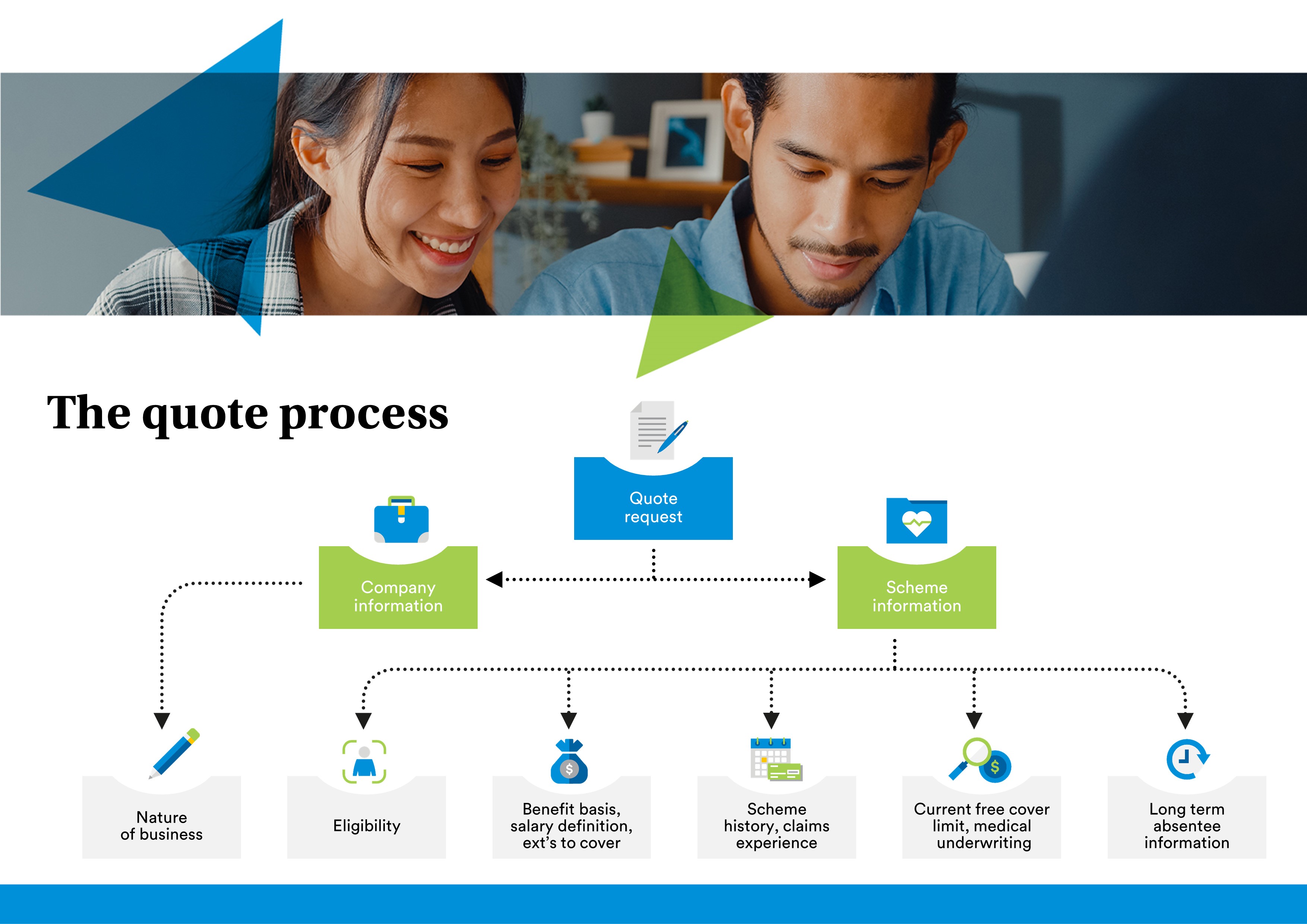

There are two main areas in the quote process.

The first is company information and scheme information and the second is member-specific information.

Company information

An insurer will need to know some high-level information about the company to provide a quote. This includes detail about the nature of the company and its business.

To obtain this, it is common to ask for a standard industrial classification or SIC code. This is determined by Companies House. If this isn’t available, an insurer may do its own research, looking at the company website and other available information to enable it to determine the nature of the business.

Understanding the nature of the business is important as it can affect risk on group risk products. A white-collar organisation, such as a business in insurance, where most employees are working in offices is generally regarded as lower risk than an organisation in the oil industry, where employees are working offshore and in more manual occupations.

It is not always so straightforward though. Some white-collar organisations can be high risk too. For example, working for an organisation in the financial markets can be incredibly stressful.

Insurers also require the postcodes where employees are located. This is more about the insurer’s risk than the policyholder’s. Some areas, for instance central London or the City, can have a very high density of organisations.

As a major terrorist event such as 9/11 could potentially affect a large number of organisations in one area, insurers ask for this information to ensure they do not have too high an exposure and can cover all their liabilities.

Scheme information

Insurers also need to understand the nature of the scheme, including any history and claims experience, to be able to assess the risk and provide a quotation. This information is split into five separate areas.

1. Eligibility

The insurer will want to know who is being covered by the scheme. Is it for all employees or just the directors or equity partners? This can affect risk, with more inclusive schemes generally lower risk.

2. Benefit basis, salary definition, extensions to cover

Information such as whether the benefit is a fixed lump sum or salary multiple provides the insurer with details of their potential liability so they can provide a quotation reflecting this.

3. Scheme history, claims experience

Understanding how a scheme has performed can provide valuable insight to an insurer. Where possible, five years’ history is ideal.

This shows an insurer how the scheme may have grown, for example, is the number of employees static or is the company growing through acquisition or in a sector where the number of employees is falling?

Claims experience is also important. This can be compared against the insurer’s own book to give an indication of whether it is higher or lower risk. Insurers can also use claims experience to determine an appropriate unit rate, adding in further expenses and fees to achieve a quotation.

4. Current free cover limit, medical underwriting

Insurers set the free cover limit in different ways, but at MetLife, having this information is important as we would look to match what is currently in place. This ensures continuity by avoiding a new group of employees suddenly having to go through medical underwriting to retain their cover.

5. Long-term absentee information

This is one of the most important pieces of information when providing a quote as it can give an indication of any upcoming claims.

Details of employee absences of more than 90 days will be requested but also any absence that would or could potentially become a claim. For example, an insurer would want to know of any recent cancer diagnoses among members.

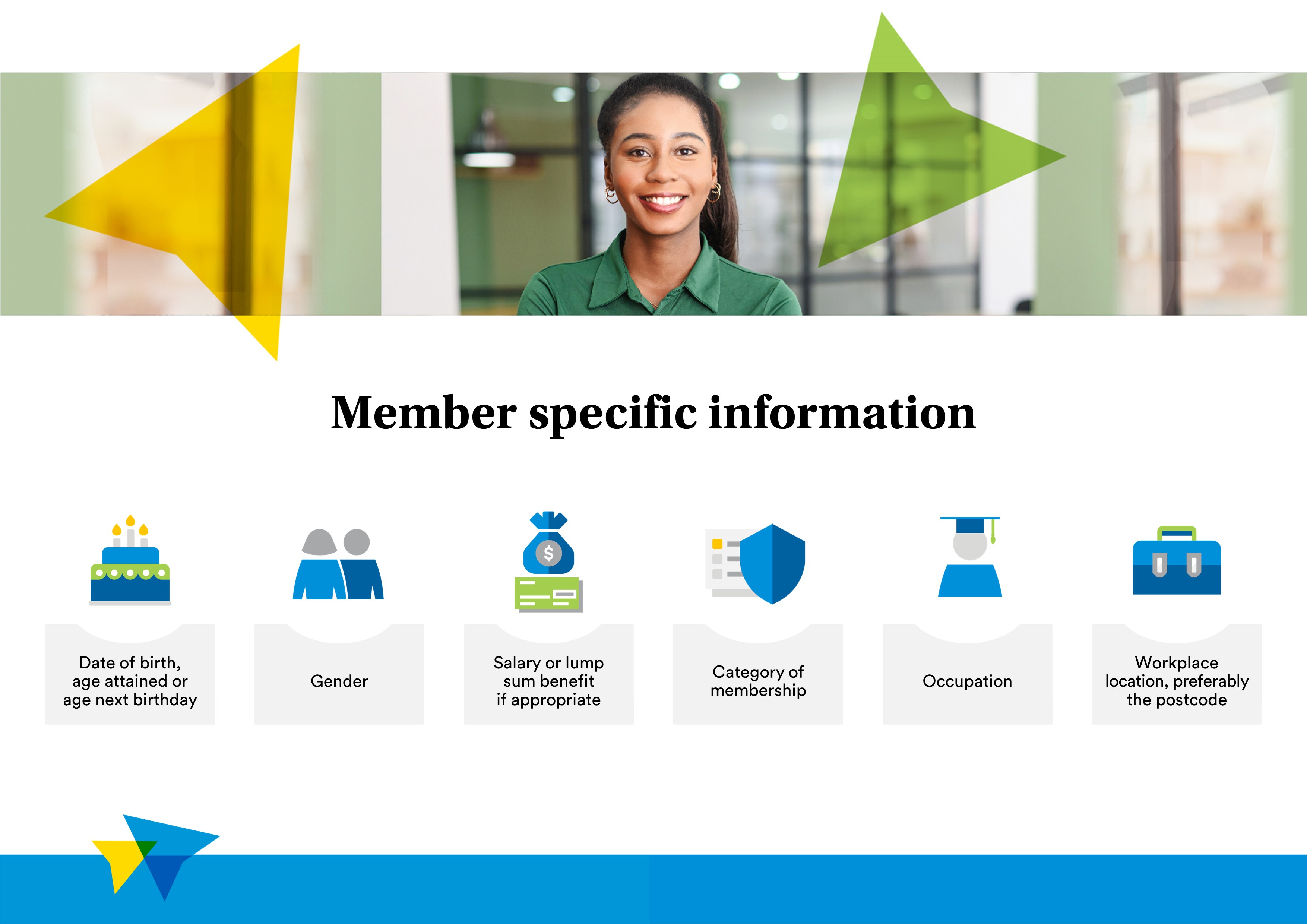

Member information

Group risk insurers also need to assess member specific information.

At MetLife, we require six pieces of data on each member who falls within the free cover limits to enable us to understand the risk and provide a quotation.

1. Date of birth, age attained or age next birthday

Risk varies with age so it is important to collect members’ dates of birth or their age attained, or age next birthday.

The way in which age affects risk varies between group risk products. On life insurance, the risk of death increases with age. However, while income protection insurers will consider how the risk of someone being unable to work due to illness or injury changes with age, they will also factor in how long benefit might be payable.

As an example, take a 35-year-old and a 55-year-old on a group income protection policy that pays benefit until state pension age. There may be a greater chance of the 55-year-old claiming but, if the 35-year-old made a claim, it would potentially be in payment for longer, resulting in a larger claim.

2. Gender

Members’ gender is also important. Statistics show that women outlive men. The latest Office for National Statistics figures show that a baby born in 2020 has an average life expectancy of 87.3 years if he’s a boy, and 90.2 years if she’s a girl.

However, when it comes to income protection, women are more likely than men to be unable to work long-term due to certain illnesses and conditions.

3. Salary or lump sum benefit, if appropriate

Having certainty around what would be paid in the event of a claim ensures there is no ambiguity.

4. Category of membership

A scheme can have multiple categories, for example directors on six times life insurance and everyone else on four times. As this can affect the cost of cover, it is important to provide this information when requesting a quotation.

5. Occupation

A member’s occupation can affect the risk they present. For example, an office-based employee is likely to be lower risk than someone carrying out a labour-intensive manual role. Some occupations can also face more stress than others. Being aware of this is particularly important when providing a quotation for group income protection.

6. Workplace location, preferably the postcode

Location can also affect risk. For example, statistics show that people in the south have a different mortality rate to those in the north.

Join the MetLife Academy mailing list

Subscribe and get access to new content when it becomes available.