Product and Insight

Summary

- In this article, we’ll look under the bonnet of group income protection, as we seek to understand what it is, what it does and how it supports employers and employees alike.

Group income protection is designed to protect employers and employees from the effects of long-term sickness absence. Where an employee is unable to work as a result of illness or injury, it will provide a replacement income as well as tailored support to help minimise absence.

The financial promise of group income protection

A group income protection policy pays a proportion of the employee’s salary if they are unable to work as a result of long-term illness or injury. Benefit is paid to the employer, who then passes it on to the employee through payroll.

Financial support kicks in after a waiting period, known as the deferred period. This is set by the employer and could be in line with sick pay arrangements or a period such as 13, 26 or 52 weeks.

Group income protection covers any condition or injury that prevents an employee working long-term, whether that’s a physical condition such as a bad back or cancer or a mental health issue such as stress or depression.

It’s a valuable financial benefit. According to Group Risk Development (GRiD), the industry paid out £546 million in income protection benefits to a total of 15,998 employees in 2021.

The average new claim paid was £28,977pa and the main causes of claims were cancer (27%) and mental illness (18%).

Support services

As well as being a valuable financial safety net, group income protection also provides access to a range of support that can help to minimise an employee’s absence.

Tailored to the employee’s needs, the insurer will work with the individual and their employer to understand the situation and develop a sustainable return to work plan. This might include reasonable adjustments to enable the employee to continue working; emotional support to help them cope in a difficult situation; and clinical interventions and rehabilitation to facilitate a faster recovery and return to work.

What makes this support so valuable is that it’s available long before any financial benefit becomes payable and insurers actively encourage employers to let them know of a potential claim within the first few weeks of an employee’s absence.

Early intervention

This early intervention works and has benefits for all parties. As well as helping an employee return to work, which is good for them and their employer, it can also minimise the length of a claim and, in some cases, prevent a claim altogether.

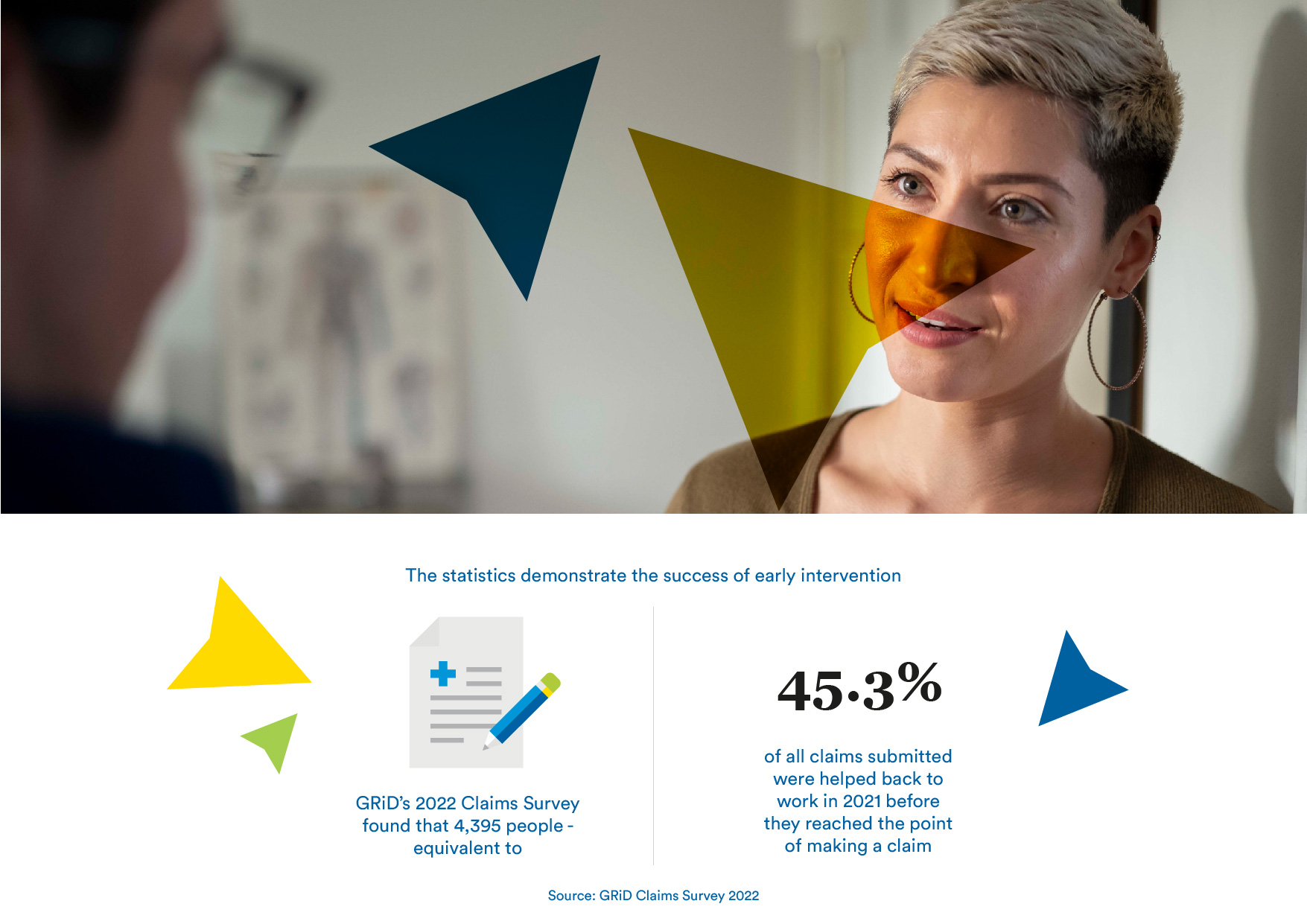

The statistics demonstrate the success of early intervention. GRiD’s claims statistics found that 4,395 people – equivalent to 45.3% of all claims submitted – were helped back to work in 2021 before they reached the point of making a claim. Of these, 54% had help to overcome mental illness and 10% had support with a musculoskeletal condition.

The earlier the intervention the better. The longer someone is off work due to illness or injury, the harder it becomes for them to make a successful return. At MetLife, we found that where we’re notified within the first four weeks of an absence, 94% of employees successfully return to work.

This focus on health and wellbeing starts long before this point too. Most policies include a range of tools and information to help employers promote health and wellbeing. These can be accessed by all employees, regardless of whether they need to make a claim.

Fully flexible cover

Group income protection is flexible, allowing it to be tailored to an employer’s needs. This could ensure it meets any promises set out in the employment contract or is matched to the organisation’s objectives and budget.

Flexible payments

Employers can flex the level of benefit they offer employees, with insurers typically covering up to 80% of gross salary. It’s also possible to include employer national insurance contributions and employer and employee pension contributions.

Indexation can be added to help payments keep pace with inflation. This could be a set percentage or RPI, where the escalation may be capped at, for example. 2.5% or 5%.

Flexible waiting times

The waiting time – or deferred period – before benefits become payable is also flexible, with insurers offering a range of options from 13 weeks to 104 weeks.

The longer the deferred period, the cheaper the premium but it’s important to consider the broader financial implications when selecting. If an employment contract promises sick pay during the deferred period, the employer will need to fund this.

It’s also important to note that, regardless of the length of deferred period, employees can still get help from the early intervention support services if they are unable to work. Using these effectively can mean that employees are successfully rehabilitated and able to return to work long before benefits become payable.

Flexible termination ages

Group income protection benefits are traditionally paid until the earlier of the employee returning to work or a specific age, generally between 65 and 70.

It’s also possible to provide cover that pays until State Pension Age. For example, at MetLife we offer fixed or dynamic SPA.

Fixed SPA pays until the earlier of the employee returning to work or the SPA at the point their absence began.

Dynamic offers additional protection. With this, the termination age is adjusted in line with any further changes the government makes to ensure there’s no gap between the employee’s group income protection benefit and their state pension becoming payable.

Modern payment terms

Shorter payment terms are also available. Paying an income until retirement is generous but, for a growing number of employers, it’s not in keeping with modern working practices, where the concept of a job for life feels very old fashioned.

A limited term policy pays benefits for a maximum payment term, from one to five years. Capping the length of time benefit is paid reduces the cost of cover while still allowing employees to benefit from the early intervention support services.

Where an employee is unable to return to work within the payment term, the employer can add a final lump sum. This could be used to help them retrain or to provide additional support with their illness or injury.

Incapacity definition

Another product feature that can be adjusted is the definition of incapacity. This determines whether a claim is eligible and insurers offer a range of different options.

The most generous definition is own occupation, which means that as long as the employee is unable to perform their normal occupation as a result of their illness or injury, they will be able to claim.

Suited occupation means they can claim providing they can’t do their own occupation or another role that’s of a similar level, salary and skill set. For instance, a business development manager might not be able to drive to visit clients but they might be able to take up a role in the office training other employees.

It’s also possible to offer own occupation switching to suited occupation, where the more generous definition is in place for the first two years before broadening out to suited occupation.

How group income protection supports a healthy workplace

Group income protection provides a valuable financial safety net where an employee is unable to work due to long-term illness or injury, but it is also an important workplace health and wellbeing tool.

Whether reducing the length of time someone is absent by facilitating appropriate rehabilitation and support, or providing employees with tools and advice that encourage them to adopt healthier lifestyles, it can help benefit the business and its workforce.