Product and Insight

There are three key products within the group risk market, each providing a valuable financial safety net for employees and their families at a time of crisis.

Short on time? Find all the numbers in this video

This video explores the three key products of the group risk market and touches on the benefits and features of each.

Group life insurance

Group life insurance is the simplest of the group risk benefits. In the event of an employee’s death, it provides a lump sum to their dependants. The amount paid is typically a multiple of the employee’s salary but it could also be a set amount.

It’s a valuable benefit. In 2021, the group risk industry paid out 13,479 life insurance claims, valued at more than £1.57 billion. The average claim was £116,414.

Rather than a lump sum, life insurance can also be set up to pay a pension to the employee’s dependants. Known as death in service pension, it’s a small and shrinking market, accounting for less than two per cent of the group life market in terms of the number of people covered.

Group income protection

Group income protection provides a replacement income if an employee is unable to work due to long-term illness or injury. The benefit is paid to the employer, who then pays it to the employee.

Policies are very flexible. Everything from the level of benefit and the waiting period to how long benefit is paid can be adjusted in line with an employer’s budget and employment contract commitments.

Employers and employees also value the rehabilitation support services that are provided. These are tailored to the employee’s needs and can help them return to work more quickly.

Group critical illness insurance

Group critical illness insurance pays a lump sum to an employee if they’re diagnosed with a serious medical condition or undergo a major surgical procedure.

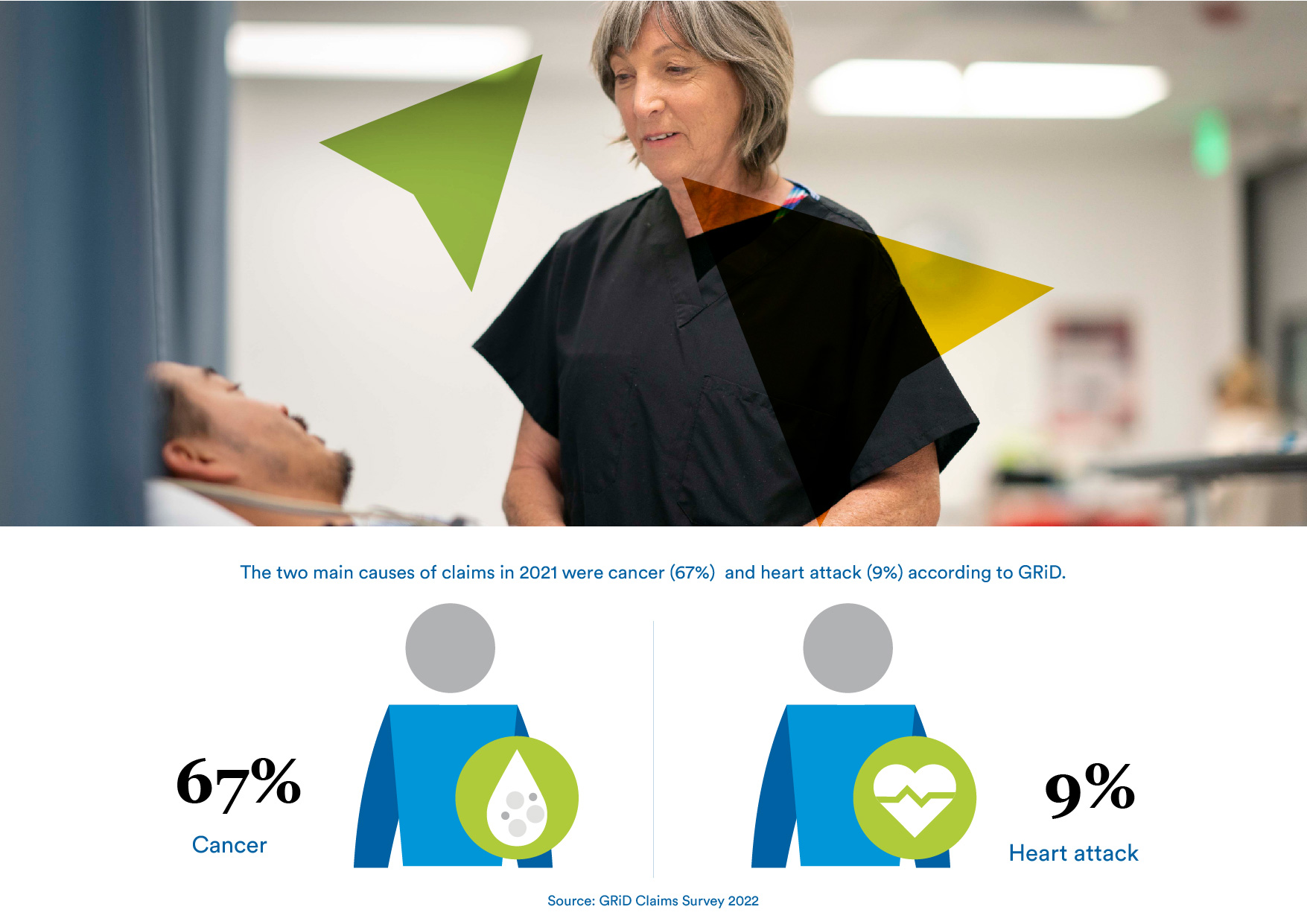

Policies set out the conditions and surgical procedures that are covered and the employee will need to survive for a specified period, typically 14 days, for a claim to be considered. The two main causes of claims in 2021 were cancer (67%) and heart attack (9%) according to GRiD.

It’s the most recent addition to the group risk stable following its success in the consumer market. And, perhaps because it’s still the smallest part of the group risk market, it’s also the fastest growing product.