Product and Insight

Group risk is a key part of the employee benefits proposition, giving employees and their families a valuable financial safety net in the event of death or long-term illness or disability. And, according to the latest figures from Swiss Re’s Group Watch report, the market is in good health.

In 2021 the group risk market recorded1:

- 4.1% increase in the number of policies in force, up from 81,055 in 2020 to 84,369

- 9.1% increase in the total in-force market premium, taking it to £2.9 billion

- 5.9% increase in the number of people insured, up from 13,317,249 in 2020 to 14,106,854

Group risk market breakdown

Alongside solid market growth, each of the group risk products recorded a strong year, with demand for cover on the up.

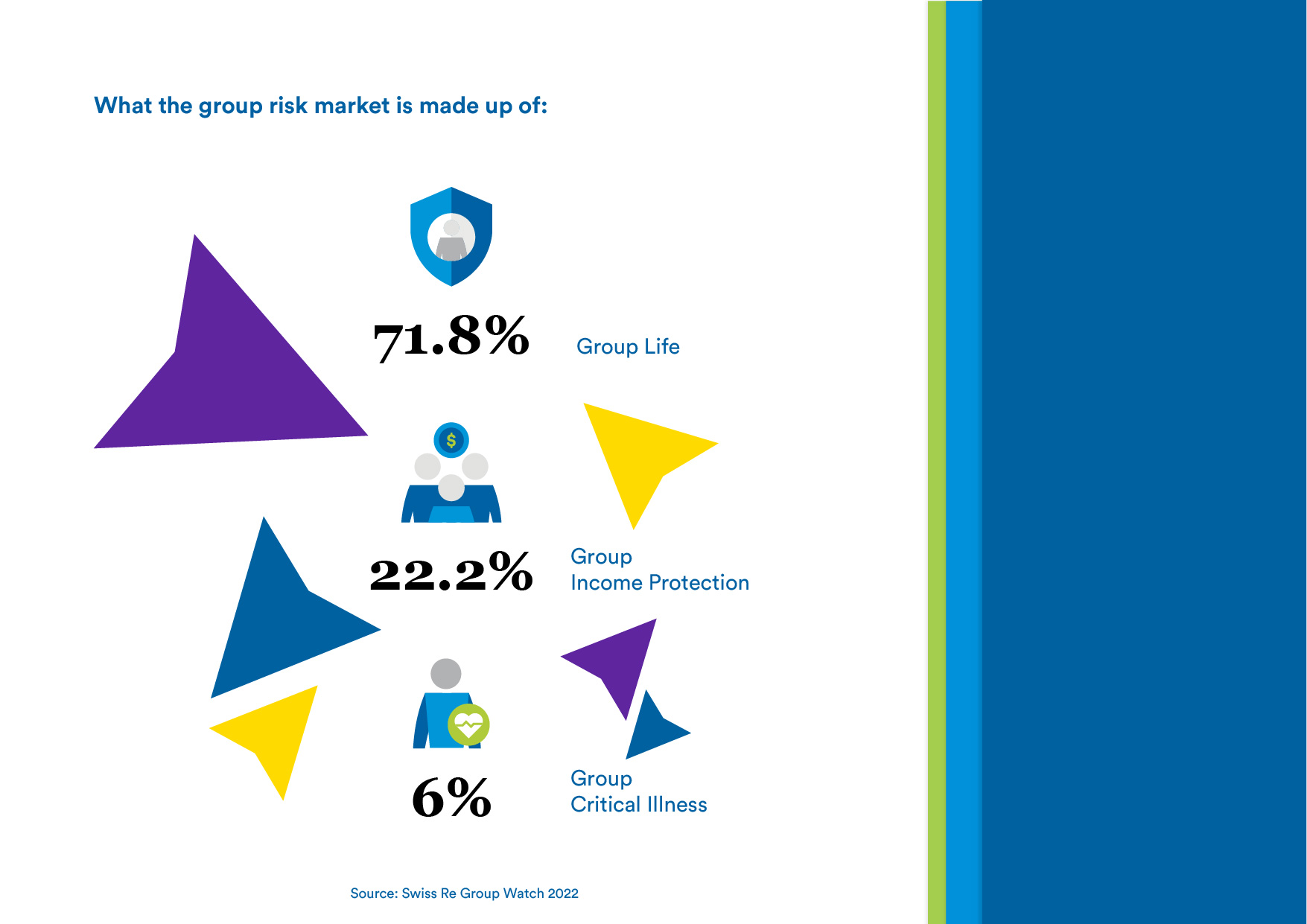

Death benefits, also known as group life, which provide a financial benefit on an employee’s death and include death in service pensions as well as more traditional lump sum death benefits, are by far the commonest group risk product, making up 71.8% of group risk policies in force in the market.

The number of lump sum death benefit policies in force increased by 4.3% in 2021 although those for death in service pensions fell by 11.1%.

The number of people insured increased by 6.3% in 2021, with 10.5 million people covered with insured death benefits.

Long term disability income, which is commonly known as group income protection, provides a replacement income if an employee is unable to work due to long-term sickness or disability.

This area of group risk accounts for 22.2% of policies in force and it saw growth of 4.3% in 2021, with the number of people covered increasing by 4.6%. This means an extra 128,347 people have the reassurance of cover.

The third group risk product is critical illness insurance, which pays out if an employee is diagnosed with a serious medical condition such as cancer, heart disease or multiple sclerosis.

It’s a more recent addition to employee benefits, with policies only accounting for 6.0% of the group risk market. Its smaller starting point means it saw the largest increase in sales in 2021, with an 8.2% growth in new policies.

Market trends

Behind the headline growth figures, Swiss Re’s report highlights some notable shifts in the fortunes of different areas of the group risk market.

In the death benefits market, there was a 42.2% increase in excepted group life policies, more than reversing a small decline the previous year. This decline may have been down to the closure of a few larger policies.

Membership of registered group life policies also increased, at a more modest rate of 0.9%. However, this type of policy is still much more popular than excepted group life policies.

The 2021 market figures also point to a continuing decline in popularity for death in service pensions. Always a niche part of the death benefits market, the number of insured members fell by 21.6% in 2021, to 174,137, although average annual benefits increased, from £10,830 to £11,522.

This is a trend we’ve noted at MetLife too, with employers seeking to modernise their group risk propositions by switching to lump sum death benefits.

Shifts in product preferences are also evident in the long-term disability income market. Although the majority – 69.1% – of policies pay benefits to retirement, more employers are adopting limited payment terms. In 2021, 17.4% of policies had a maximum benefit term of five years – up from 9.4% in 2015 – with a further 13.5% of policies offering other limited payment terms.

This trend is expected to continue. As well as reducing costs, many employers regard a limited payment term as more appropriate to modern working practices.

The SME market also deserves a mention, thanks to its healthy appetite for group risk products. Between 2019 and 2020, there was growth of 9% in policies taken out by companies with between 50 and 249 members.

Future expectations

The value of group risk products to both employers and their employees means we expect to see further growth across the market over the next few years.

The pandemic has heightened awareness of importance of health and, with the Great Resignation still in full swing, employers are under pressure to improve their benefits to attract and retain talent. The group risk market is in an ideal position to benefit.

1. All data from Swiss Re Group Watch 2022