Adding Value

Group Life insurance is the simplest of the group risk products, with benefits paid on the death of someone covered by the policy. While proving this is straightforward – and more than 99% of Group Life claims are paid – there is a risk of the claims process becoming overcomplicated.

It’s important to avoid this. Having to make a claim on a Group Life insurance policy can be difficult and distressing, with the death of any employee often affecting many within an organisation. Ensuring the claims process is as simple as possible helps to minimise additional stresses at this difficult time.

To keep the claims process straightforward, insurers work closely with brokers and employee benefits consultants to understand what is required to validate a claims and make a payment.

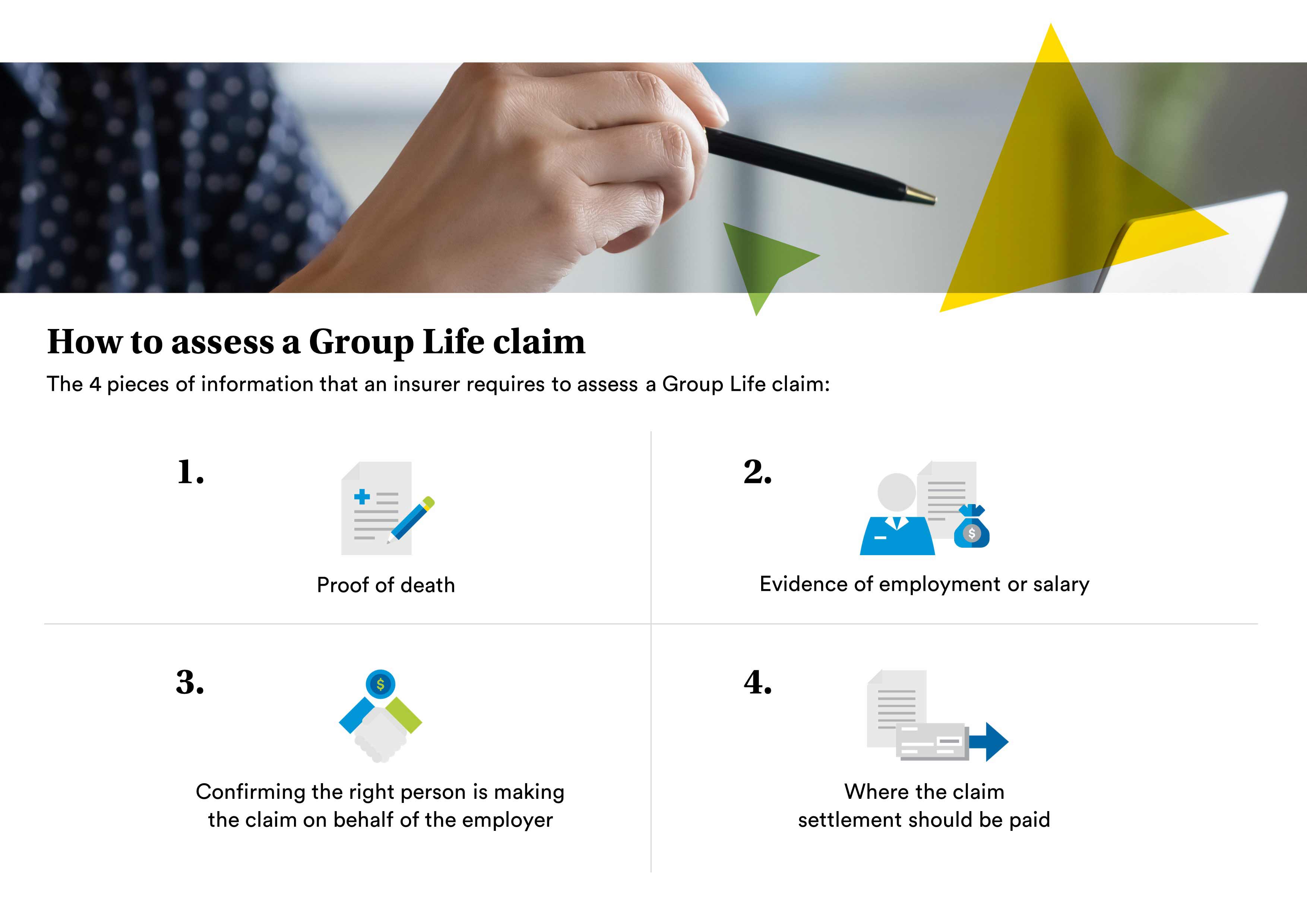

As a result, at MetLife, we break a claims process down into four simple steps, as follows:

- Proof of death

- Evidence of employment or salary

- Appropriate person making the claim

- Payment details

We will now explain each of these steps in more detail, highlighting where any additional information may be required. This will ensure that where a claim is more complex or unusual, the right details can be provided quickly.

Proof of death

The first piece of information that is required is proof of death. In most cases, insurers can validate this through the government’s online death register. This holds records of all the deaths that occur in the UK.

In a few cases, the online register won’t be able to validate a claim. This might be where the death was in the past 14 days, as it takes two weeks for the records to be updated on to the death register; where the death occurred outside of the UK; or where there is a coroner’s inquest ongoing into the cause of death.

In these situations, insurers will ask for documentary evidence to confirm the death has been recorded. Some will ask for the original death certificate but many, including MetLife, will accept a copy of the document.

Evidence of employment or salary

An insurer will also need evidence that the individual was covered under the Group Life policy.

This is usually straightforward as the insurer will hold details of the members of the scheme but there are some circumstances where further information is required, for example where the individual had only recently joined and hasn’t been added to the member details.

Where this is the case, the insurer will ask for further evidence, such as a pay slip to show they were employed by the company or a claims form where the employer confirms their employment and eligibility for benefits under the scheme.

Appropriate person making the claim

Another key part of the claims process is confirming the right person is making a claim on behalf of the employer. At MetLife, we ask our clients to give us details of the people who are authorised to deal with claims on their behalf.

Providing a claim form is submitted by one of these ‘authorised’ individuals, we can progress with assessing the claim.

Payment details

The final piece of information required in the claims process is where the claims settlements should be paid. This detail needs to be included in the claim form to confirm the insurer is paying the money to the right person.

Where an organisation uses a master trust to cover the trustee responsibilities, the benefit from a group life claim is paid directly to the master trust. The trustees will then determine how the proceeds are distributed, identifying the most appropriate beneficiary or beneficiaries – typically next of kin or in line with the deceased’s wishes.

With a master trust, the trustees are also responsible for ensuring they have the correct information to pay the money to the beneficiary or beneficiaries.