Adding Value

Summary

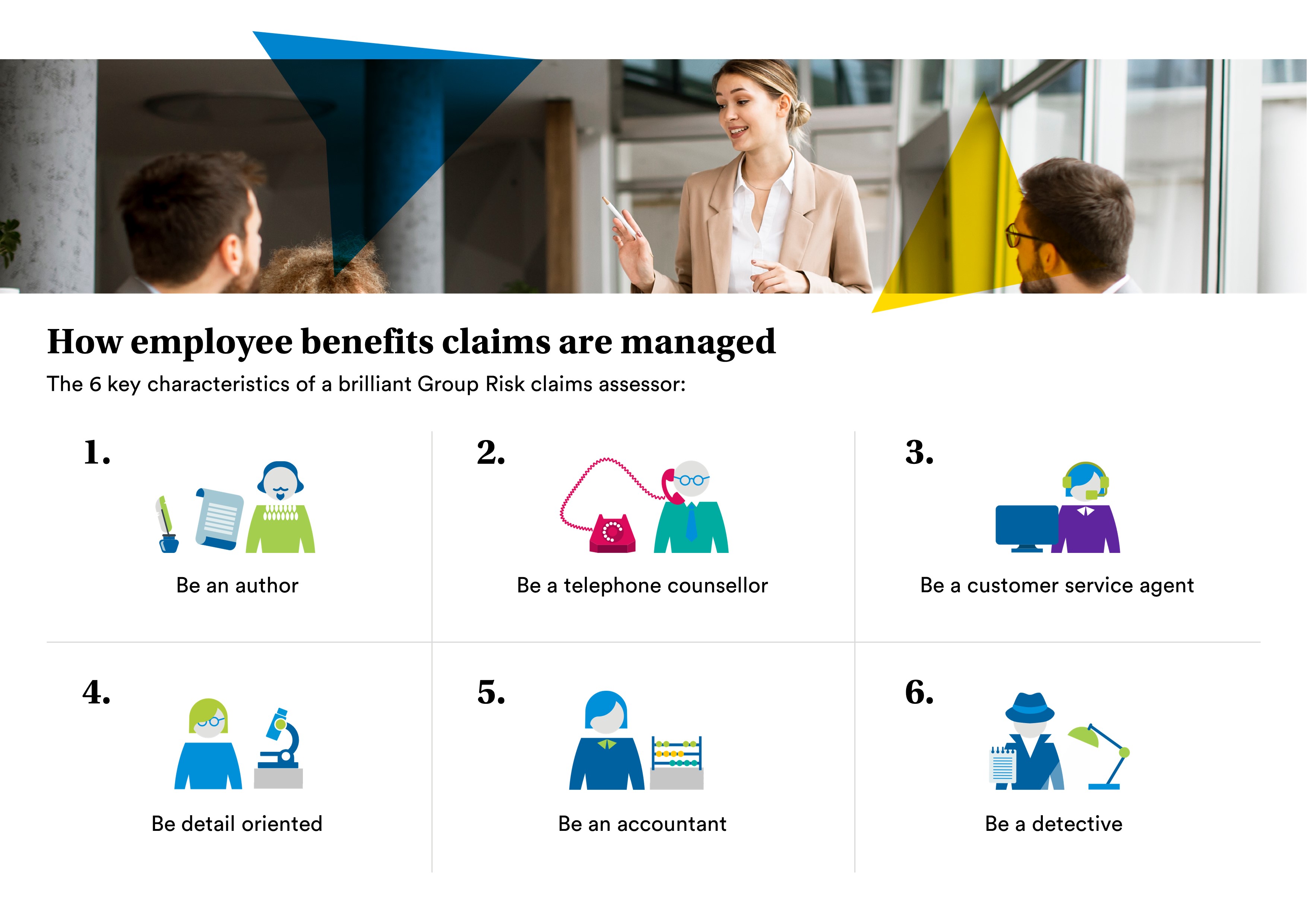

- Explore what it takes to create the perfect claims assessor and the key characteristics required.

A claim is the moment of truth on an insurance policy, with customers discovering exactly how the insurer responds in their moment of need. As claims assessors play a key role in shaping a customer’s experience, it is important they have the right skills to deliver outstanding service.

Good communication and customer service skills are essential but a good claims assessor will have additional capabilities such as an eye for detail and numeracy, which will help them make the right decisions and communicate them effectively to customers.

Short on time? Get all the information you need, here.

This short video explores the six key characteristics of employee benefits claims assessors.

These are the six key skills that enable a claims assessor to successfully manage claims and help customers get the best outcomes.

Be an author

A good claims assessor must be able to communicate a decision in a way that provides clarity around the outcome of a claim. This often means ditching the insurance jargon and terminology in favour of more accessible everyday language.

Tailoring the message to the audience is often key to this. Claims assessors may be dealing directly with the employee, the employer or its HR department, or the organisation’s employee benefits consultant.

Although each of these parties may require the same information, the approach needed to communicate with an employee coming to terms with a health issue will be markedly different to that used to provide a broker with headline information on a claim so they can share it with their client.

Be a telephone counsellor

Good claims assessors are also great when it comes to dealing with people on the telephone. As well as being able to communicate in a clear manner, this requires them to be a good listener.

Understanding why someone is calling and giving them the time and space to tell their story is hugely important in claims. The information they provide can support the claim but can provide additional insight into what they need and how the claim can progress.

As it’s such a valuable exchange for both the caller and the claims assessor, it’s sometimes referred to as telephone counselling.

While this may not be in the true sense of a counselling service, the soft skills needed to listen and understand someone’s situation and provide them with the information, support and reassurance they need helps to deliver a good claims experience.

Be a customer service agent

Another key characteristic of a claims assessor is exemplary customer service skills.

Good communication and telephone skills are part of this, but claims assessors must focus on making sure that every time they interact with a claimant, they deliver a great customer experience.

For any insurance product, the test of its quality comes when a claim is made and the customer gets to see whether the insurer fulfils its promise. This means that customer service must be implicit in everything a claims assessor does.

The way a claims assessor handles a claim can shape the employee’s perception of the insurance company, and insurance more broadly, but it also provides the organisation, and/or its broker, with the reassurance that any future claims will be dealt with in a similar way. Putting the customer at the heart of what they do is key – both for that claim but also future business and relationships.

Be detail orientated

A good claims assessor also has an eye – and an ear – for detail. While some claims are very straightforward, others will be incredibly detailed, pulling in information from a wide range of different sources.

For these more complex claims, a claims assessor will need to be able to take all this information into consideration, making sure they’re interpreting everything correctly, when deciding what should happen with the claim.

This skill is often developed in the role, with claims assessors learning from their own experience but also that of their colleagues.

Employee benefits claims involve people so while there are similarities, no two claims will ever be the same. Being able to spot the details and incorporate them into their claims assessment helps to deliver a great customer experience.

Be an accountant

People skills are essential but it’s also important for a claims assessor to be comfortable with numbers. Understanding the level of benefit that will be paid and what any calculation is based on makes it much easier to pass this information on to customers.

It’s not necessary to have a grade 9 in GCSE maths – although nobody would complain – as insurers automate their benefit calculations.

However, being able to understand what the benefit represents and how it has been calculated will really help when speaking to customers about their claim.

Be a detective

The final skill, and the one that sounds the most exciting, is to be a detective. Claims assessors need to be able to identify situations where they might need to verify the data they already have or pull together some additional information to understand the claim.

Some claims will be simple – the open and shut case to put it into detective speak – but others may require some detection work.

This might be bringing together different pieces of information for interpretation or asking additional questions to enable a claim to be settled.

Although the risk of a member making a claim increases with age, the size of the potential claims payment also reduces with age. As a result, rates start to fall as a member’s age approaches state pension age and the potential claim size is limited.

Female rates also tend to be slightly higher than male rates on group income protection. This is because they are more likely to suffer an illness or injury that prevents them from working long-term.

Calculating an organisation’s base rate

To calculate the base rate for an organisation, an insurer would take the rate for each member and multiply it by the benefit level they have, to get their base rates.

Every member’s base rate is then added up to achieve a rate for the policy. Therefore, although a single rate will be attributed to the organisation, it will reflect the risk presented by the individual members who will be covered by the policy.