Adding Value

Group income protection provides a financial safety net if an employee is unable to work long-term as a result of illness of injury.

While this protection is valuable, the range of value-added services included on the product can help to keep employees healthy, happy, and productive.

With 68% of employees seeking companies who show they care, these benefits can provide the tools that respond to employees’ new values and practical needs.

Early intervention

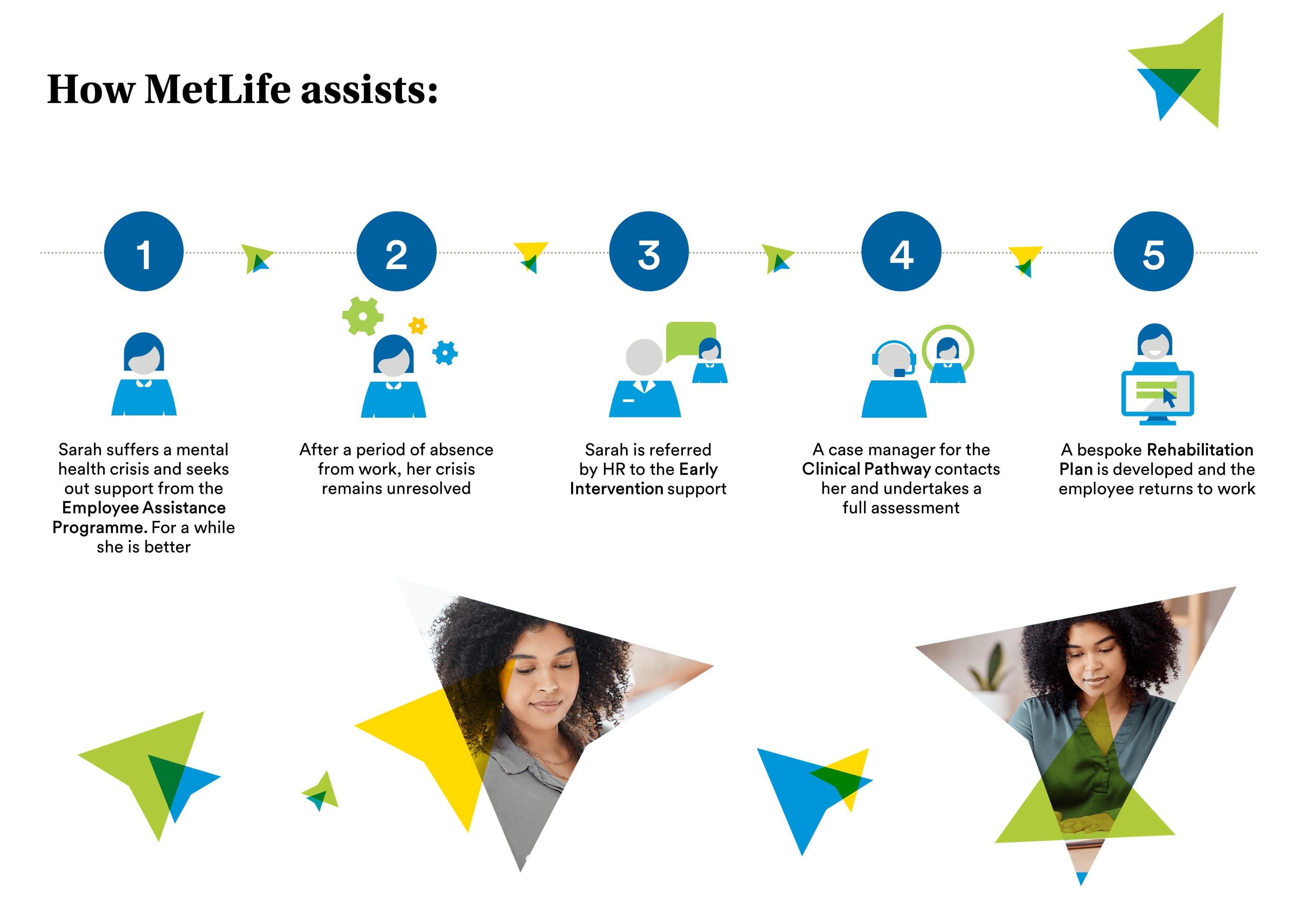

Early intervention is one of the most significant additions to group income protection, benefitting employees, employers and insurers alike.

An insurer’s early intervention team will engage with an employee as soon as they are aware of their absence, ideally in the first few weeks of absence and long before a claim can be submitted. Once notified of an employee’s absence, the team will work with them and their employer, to help them return to health and work successfully.

The help an employee receives depends on the nature of their absence but it could include clinical support, counselling or adjustments to their role or the workplace.

Throughout it will focus on the employee’s needs and how they can be returned to health and to work.

How does Group Income Protection support absence prevention?

One of the key benefits of early intervention is that, by helping employees return to work, it prevents them becoming long term claims. The longer someone is absent, the lower their probability of returning to work. After 13-18 weeks, the probability falls to 62% and, by 28 weeks, it’s down to 42%.

As these services respond long before the end of the deferred period when a claim becomes payable, it’s possible to prevent many employees from becoming claims altogether. As an example, at MetLife, around two-thirds of the employees we support with early intervention return to work before their absence turns into a claim.

To gain the maximum benefit from early intervention, employers must have the right procedures in place to notify their insurers as early as possible. We were able to help 94% of employees return to work when we were notified of their absence within the first four weeks.

Rehabilitation support

Providing the necessary support to get someone back to work before they become a claim is the ideal, but group income protection can also help employees with rehabilitation support after a long period of illness or injury.

This works in the same way as early intervention, with the rehabilitation team liaising with the employee and employer to assess what is needed to help them return to work. Again, it might be medical support, such as physiotherapy or counselling, but it could also be adjustments to the workplace or their role that facilitates a return.

Group income protection insurers take a flexible approach to this, helping an employee return on fewer hours or to a lower grade where it is appropriate. In these situations, claims payments can be adjusted to ensure total remuneration is fair and that both the employer and employee benefit from the return to work.

Health and wellbeing support

As well as supporting employees who are – or could be – off long-term due to illness or injury, group income protection also includes several added-value services that can be used by all employees. This means that more employees will appreciate the cover their employer offers.

One common addition to group income protection insurance policies is an employee assistance programme (EAP). These provide 24/7 access to expert advice and information to support an employee’s emotional, physical, and mental wellbeing.

Employees, and their families, can get help and advice on anything that concerns them, with many EAPs also offering access to face-to-face counselling sessions where necessary.

Medical advice

Virtual GPs are another value-added service that really delivers. These are also available 24/7, giving employees access to a GP by phone or video at a time that suits them.

Being able to get medical advice quickly and when an employee wants is convenient. They don’t need to take time off to visit a GP surgery and can even be seen the same day.

It can also be reassuring for employees and their families. If treatment’s needed, catching it early can mean a better outcome: and if nothing’s wrong, they can stop worrying about their health and get on with their life – and work – again.

Clinical pathways

Due to the nature of Group Income Protection, and the way that early intervention works, insurers want to be able to provide those will illness or injury a quick way back to recovery. And sometimes that means with specific pathways that address specific needs.

For example, a mental health clinical pathway might provide a struggling employee with a bespoke rehabilitation plan that addresses their needs, while providing a tailored return to work plan that accommodates any adjustments required.

It could provide signposting for treatment and counselling, access to early intervention, or even give employers the appropriate tools to deal with symptoms before they lead to ill health.

Workplace programme

Having all these value-added health and wellbeing services included with group income protection benefits employers too. As well as giving their employees access to additional support, an employer could use them to create a workplace health and wellbeing programme.

Employers increasingly need to foster a culture of care and belonging, and a targeted wellbeing and benefits strategy helps to bridge some of the gaps that we identified in our 4 R’s research.

Telling employees about the value-added services or using them to complement a themed health awareness week can bring an organisation’s health and wellbeing strategy alive. Supporting employee health in this way drives engagement too, with benefits for talent attraction and retention.

How MetLife supports its customers through value-added services:

Our Group Income Protection value-added services supports employees through ill-health and injury. Here are the value-added services that are included on MetLife’s Group Income Protection insurance product:

Early intervention

A specialist team works with employees and employer to help them return to work before their absence turns into a claim. Support is tailored to the employee’s needs and could include clinical interventions, counselling or adjustments to their role or the workplace.

Clinical pathways

Employees with musculoskeletal conditions, mental ill-health or Long Covid can take advantage of a structured clinical pathway of treatment and support. Each pathway ensures they receive the most appropriate support at the right time to assist their recovery.

Rehabilitation and return to work support

A service providing support to employees to help them return to work after a long period of illness or injury. Like early intervention, support is tailored to the employee and could include medical interventions, counselling or adjustments to their role or the workplace.

Employee assistance programme (EAP)

A telephone-based support service available 24/7, 365 days of the year. Employees, and their families, can speak to an impartial adviser who will be able to provide support and information on any health and wellbeing issues. Advisers can also refer employees to specialist support from legal advisers, counsellors, registered nurses and midwives.

Virtual GP

A 24-hour service giving employees and their families same day access to a GP by phone or video. Employees can have as many consultations as they need, at a time that suits them and wherever they are in the world. As well as GP consultations, this service covers second medical opinions, open referrals, and local prescription deliveries. This service is available for Group Income Protection schemes under 1,000 lives.