Adding Value

Summary

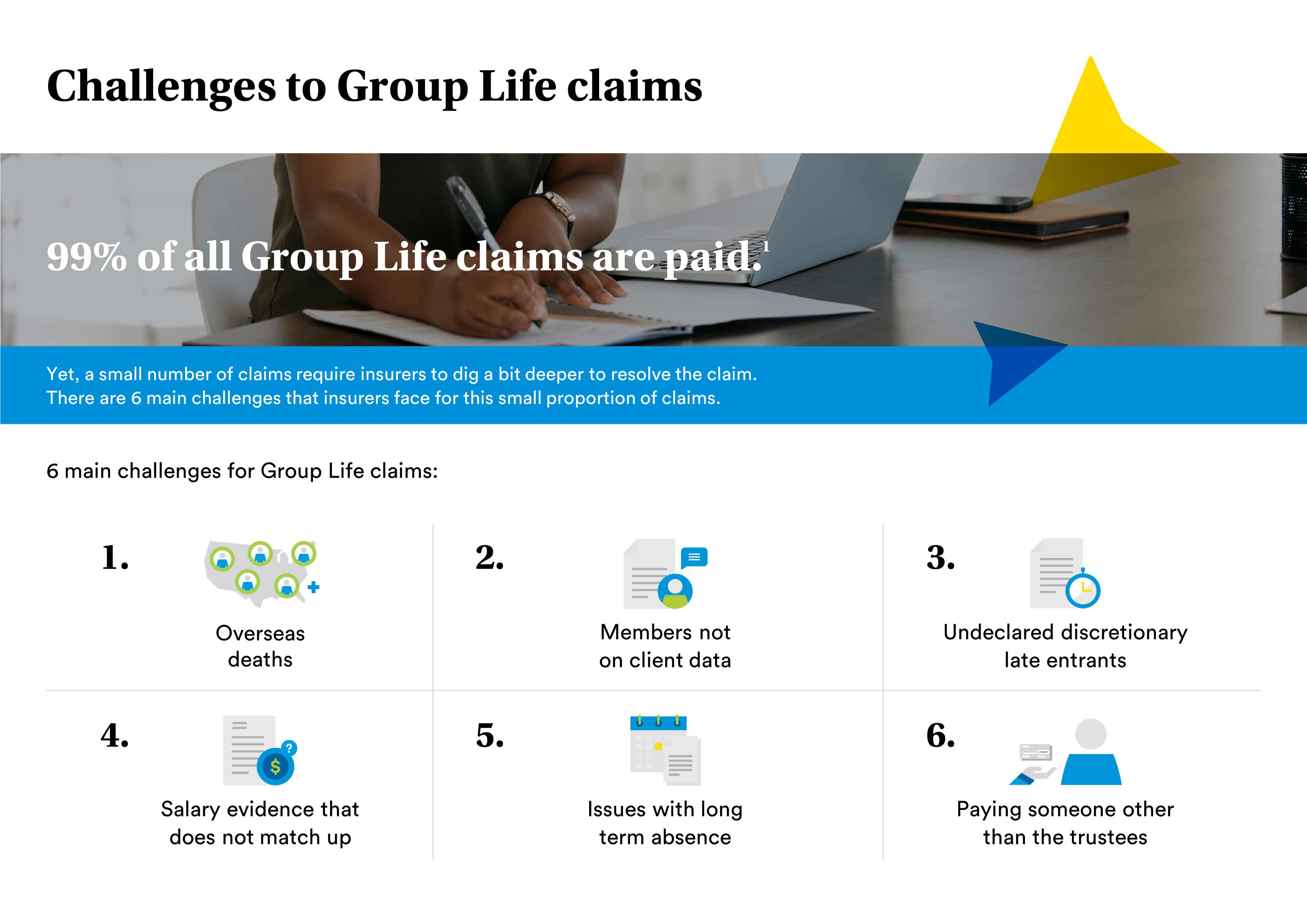

- For the less than 1% of Group Life claims that aren’t settled quickly, some will require further investigation. Here are some of typical challenges.

More than 99% of group life claims are paid, with the majority of claims settled quickly and efficiently. However, as well as a tiny percentage that aren’t valid, there are some claims that require further investigation.

Wherever possible, group life insurers seek to pay the right amount at the right time in an efficient manner. Figures from Group Risk Development (GRiD) show that in 2021, 99.82% of new claims were paid, with employees’ beneficiaries receiving £1.57 billion in benefits.

From a customer service perspective, it is also important to identify and manage the tiny proportion – less than 1% – of claims that are declined.

Even though the claim is not being paid, the insurer needs to explain the reasons it has been declined as quickly as possible so the client can decide what they should do as a result.

There are also a small proportion of valid claims that are more challenging than others and require further work.

These are the main challenges we come across and how we resolve them.

Overseas deaths

Overseas deaths, particularly where the body isn’t repatriated to the UK, can be a challenge.

Normally we would use the government’s online death register to validate a claim. But, as this only covers deaths in the UK, we would need additional documentation where a death occurred overseas.

The level of documentation varies greatly so we will often factor in additional time to deal with these claims.

Members not on data

The data for a group life scheme is really important to an insurer. It tells them who they’re covering; what the risk is; and how much they need to pay out.

Sometimes we find situations where the claim is for someone who isn’t in the data.

What we do depends on whether we would have expected them to be in the data or not. For example, as data is provided to us at set points, such as the start of the scheme year, it would be acceptable for someone who joined after this point not to be included.

For these new joiners, the process is straightforward. We can validate their entitlements and benefits through salary roll and by confirming details of when they joined with the employer.

There are other situations where someone isn’t included in the data but we believe they should have been, for example because they were working for the employer when the data was submitted.

There are several reasons this can happen. It may be down to the way the business is set up, or that employees are spread across different locations or businesses within the group.

In these situations, the best way to understand whether the claim is valid is to speak to the broker or client to work out what’s happened. Contacting them as soon as we identify a mismatch ensures we can resolve these issues and where the claim is valid, settle it quickly and efficiently.

An ‘undeclared discretionary late entrant’ can also cause a challenge on a group life claim.

These are individuals who weren’t automatically entered into the scheme as they didn’t meet the standard eligibility requirements. As they were unable to join alongside other employees, they became a late entrant and their details were not passed to the insurer.

This might be the case where membership of the group life scheme is linked to the pension benefit, a grade or length of service and the employee joined the scheme outside the normal enrolment period.

To determine whether they were covered, we will always contact the broker or client as quickly as possible. Discussing what happened and why they were an undeclared discretionary late entrant enables us to make the right decision on the claim.

This decision will also look at whether the inclusion of the late entrant on the scheme would have affected pricing.

This decision will also look at whether the inclusion of the late entrant on the scheme would have affected pricing.

Salary evidence that does not match up

Claims should match the salary information the insurer holds so if there is a mismatch it will require further investigation.

In some cases it can be down to pay rises but we will always contact the broker or client straightaway to find out why there is a mismatch. It may also be necessary to obtain salary evidence to support the claim.

Long term absence issues

When an employer takes out a new policy, adds new members or increases benefits, the insurer requires details of which employees are actively at work and which are long term absent. This information is factored into the underwriting and pricing of the scheme.

In some cases, insurers receive claims for someone who was a long-term absentee but this information was not advised to the insurer. Again, we will get in touch with the broker or client to understand why this has happened. Having this insight enables us to work out the right solution.

Paying to someone other than the trustees

Paying a group life claim to a trustee is the simplest way to settle a claim but, providing we have the necessary information, it is possible to pay other parties too.

Some schemes will operate through a master trust. In these situations we can make the payment directly to the master trust, where the trustees will determine how the proceeds are distributed, typically to the next of kin or in line with the deceased’s wishes.

There are also some schemes where there isn’t a trustee account or a master trust arrangement in place. For these, as long as the client provides document to confirm eligibility, we can pay the benefit directly to the beneficiary.

Communication is key

Mistakes do happen, whether with salary information or member data, but we recognise that communication is key to resolving these issues.

Whenever something doesn’t tally on a claim, we speak to the client or broker to find out why this might be. This enables us to consider what position the employer should have been in and how it might affect the terms of their cover and the claim we’re handling.

We are mindful of the Insurance Act too, including the duty of fair presentation, and will act where there has been a material misrepresentation of risk information. But we also recognize that some mistakes are genuine.

Having a conversation with the broker or client to understand what happened and how we can help is key to resolving these more challenging claims.